Dimensions of DEFI Passive Income: Introduction to Yield Farming, Staking and Liquidity Pools

This article is the first part of a series that explains how to make passive income from Yield Farming, Liquidity Pools and Staking. Enjoy!!!

Cryptocurrencies, Web3 and DEFI technology have evolved beyond just “buying and selling tokens”. Protocols, Yield Farms, APY, Governance, Staking, Impermanent Loss, AMM, NFT Flipping, etc are terminologies flooding the space thereby exposing users to different investment opportunities if harnessed properly. The looming absurdities may provide a steep learning curve but beneath all the daily buy and sell $BTC or $ETH signals available to crypto enthusiasts are huge prospects of making it big.

DEFi stands for Decentralized Finance. The DEFI space has seen new models of investing and earnings erupt daily. This ranges from basic crypto trading to bounty rewards as well as incentivized programs(majorly airdrops) making the prospects of the technology not only profitable for stakeholders but daily users. This is in tandem with the slang WAGMI-We All Gonna Make It, an acronym that resonates the idea that anyone can make it if hungry for information, take actions, build solid skills and be part of communities. Looking at the concepts and logic of what Blockchain technology truly is, WAGMI hits home and is not far-fetched from the concepts of openness, transparency, immutability and efficiency.

Technology only gets better with time and this is applicable to other parts of human life, finance inclusive. Once upon a time we had no idea what computers were, no one had seen a keyboard ever. Now we are talking of disruptive tech like metaverses, drones, blockchain, dapps etc. Few years back all we knew about crypto was buying some tokens on a blockchain wallet, and at this time Bitcoin(BTC) was the only cryptocurrency pioneering the blockchain space. Currently, there are over 100 blockchains and protocols, numerous decentralized exchanges(DEX), bridges and decentralized apps(DAPPS) that give more options to users popping up everyday. As of today many now understand Bitcoin as a store of value, a huge amount of the blockchain enthusiasts are building and interacting with Ethereum as a platform for tokenization, introducing layers for protocols and mind-blowing use cases. Cosmos, the internet of blockchains has so many goodies they are unlocking daily.

Is There Really Money In Blockchain or Crypto As They Say?

DEFI is now a multi billion dollar industry and it is here to stay. For those who pay attention or who climb to the apex of society during such shifts in society, the secret is information, pragmatism and being present. Web3 and DEFI technology is driving new paths which places the users at the forefront of infinite possibilities. The key here is the “user” simply because you have access to an ocean of opportunities as long as you do not limit yourself with short-mindedness or pessimism. Research erodes doubt for those who have fears of what the technology brings with it. Getting the right information solves the problem halfway and here I would be discussing some of the gems of earning in the blockchain space. These are some secrets the early adopters of DEFI know and are cashing-out from. One major aspect of DEFI is passive earnings and it’s only right that I attempt to elaborate on the concepts here. Everyone now gets a fair shot at making it big in life; I mean that’s what blockchain is about.

Gamers earn from play-to-earn games like Axie Infinity or MetaverseMagna. Recently Cosmos has been innovative with improving game economies by bringing lasting value to gamers by letting them take their earnings to other games or into the real world.

Artists and creatives make money from NFTs without intermediaries. Bored Ape Yatch Club(BAYC), Doodles, Afrobubble and the recent HazeMonkey Club are highflyers of the sector. Individual artists like Shutabug and Anthony Azekwoh are doing great like millions of others. NFT flipping is making millionaires every second of the day also.

Anyone can monetize content with Opulus and Flok.

Protocols give free $$$ to early adopters or believers in their tech etc. Polygon, Cosmos Network and Solana have this on lock. Their teams and contributors are building relatable products with enviable ingenuity.

Firstly, What Is Yield Farming?

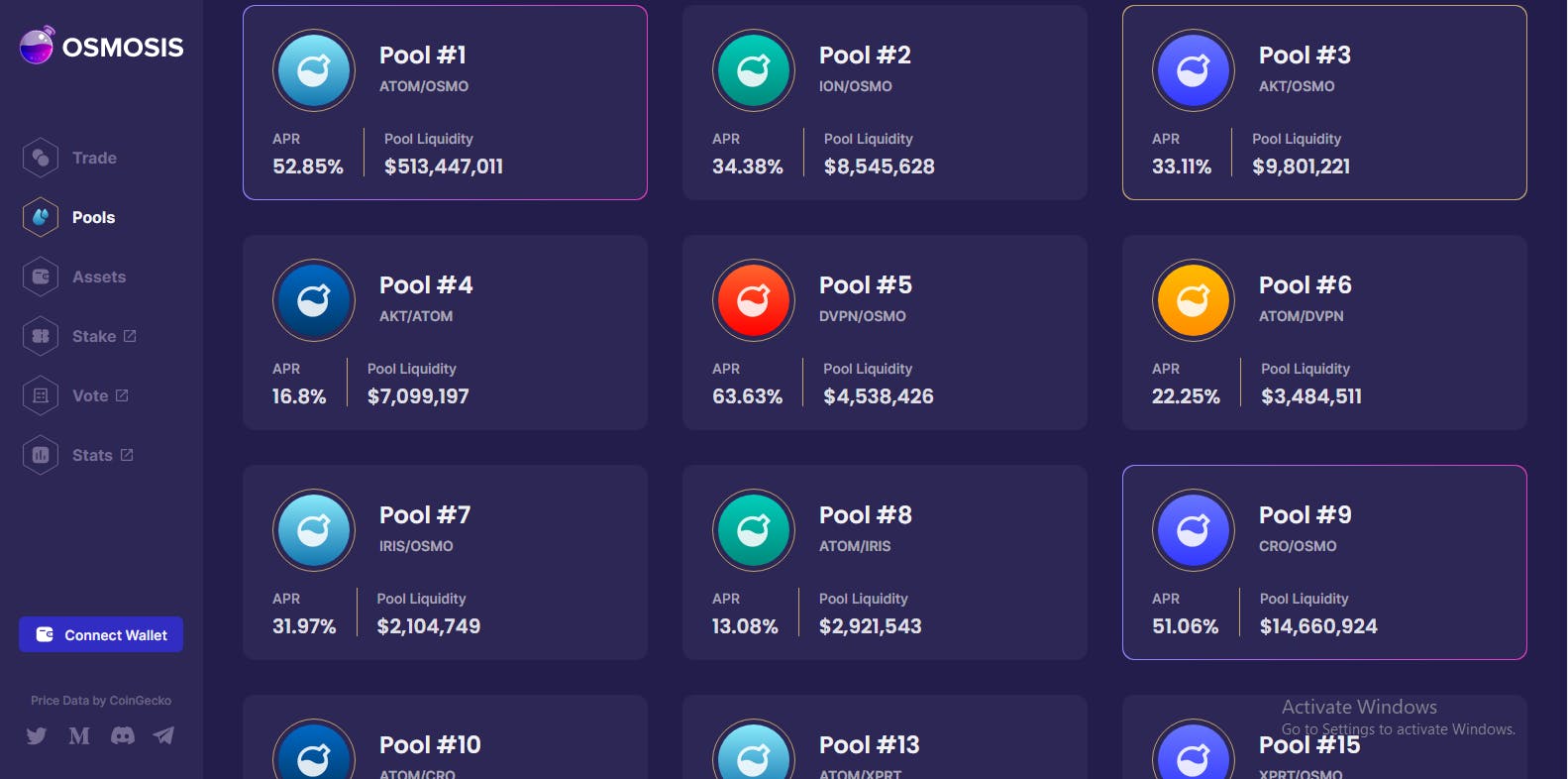

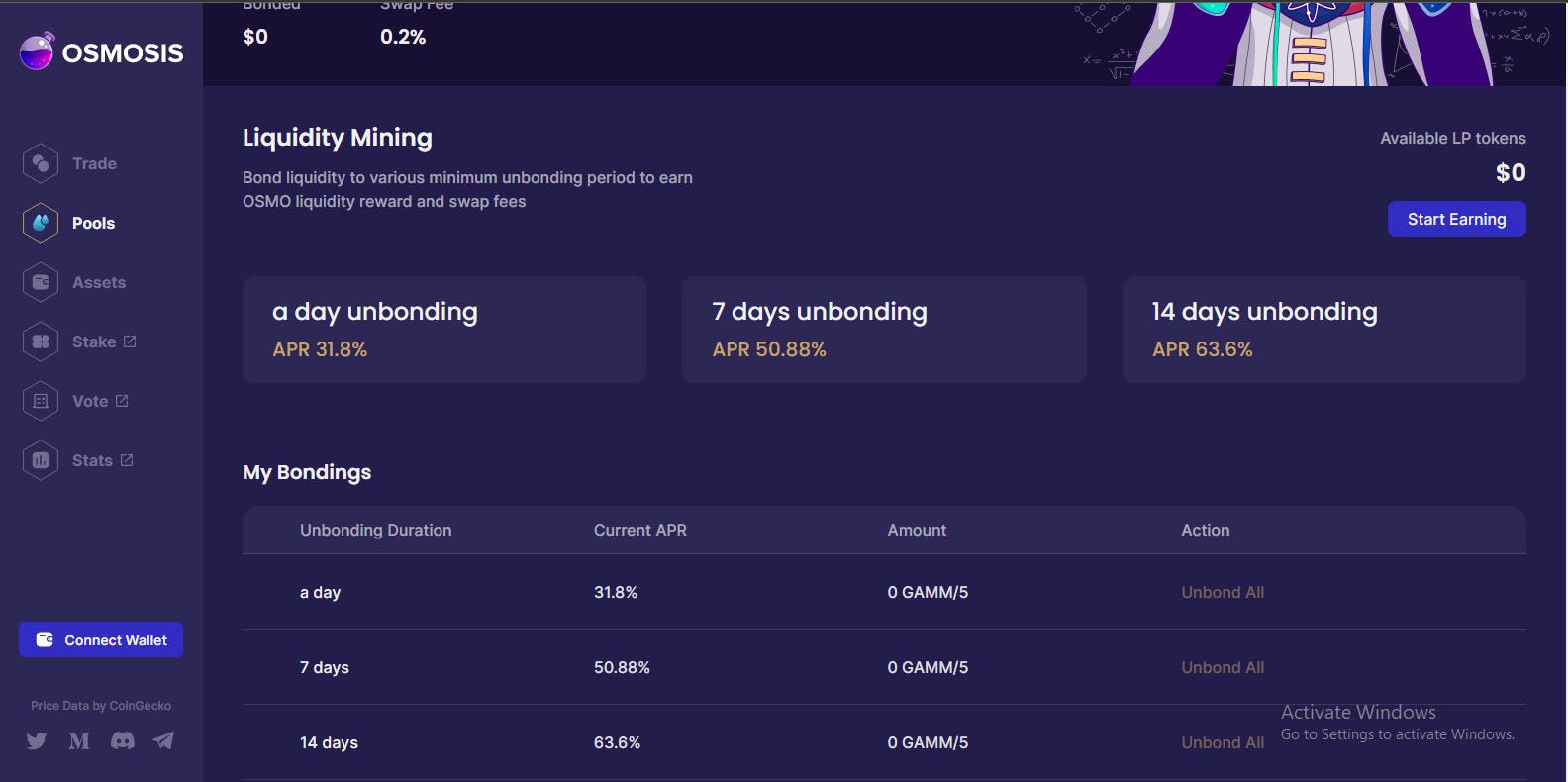

Yield farming allows users to increase their earnings from crypto holdings. A unique token is obtained for providing liquidity to pools, and it is known as the Liquidity Pools-LP token. This enables them to distribute income and contribute to the platform. The process involves lending crypto assets for interest to DEFI platforms, who lock them up in a liquidity pool. The extra passive income comes from yield farmers' profit sources, which include capital appreciation, token rewards, and transaction fees. This is somewhat almost like earning interest from a bank account but with more interest rates, smart contracts, volatility and huge returns.

So here’s a quick question, when was the last time your bank gave you free money or paid you for investing or saving your money? Well, in the DEFI and blockchain space the idea is to make everyone make it or have a shot at life. Hence, there are lots of incentives like free money or rewards in the form of airdrops and also returns for investing, staking or borrowing tokens. These platforms gives rewards once a user becomes an active participant in the community, and all the best is still waiting for you

To make passive income through yield farming, users frequently provide or lend liquidity using a cryptographically secure DeFi protocol. Imagine if Apple or Google gave out some rewards to early users with their own stock or cash, which allows early users to have a say in how Facebook is governed or built and they still earn from appreciating stock value or selling off rewards. Nobody could have predicted how lucrative Facebook or Apple would have turned out at their very early days and those who were bullish(trusted and invested) in the company would gain massively once the company became profitable.

Assuming that someone urges you to deposit some crypto or NFTs in order to infuse liquidity into a new or current protocol, and that in exchange, you will be rewarded with hundreds of little unknown currencies every day for a period of time. Such unknown tokens may appear to be useless at first, but eventually when the project develops a use case for them, they may be worth a considerable amount of money (thousands of dollars), while your initial investments are secure in a smart contract that you can access at any time.

Anyone can lend or borrow tokens to the protocols through the liquidity pool. When you provide such tokens by lending or staking, you are called a Liquidity Provider. Daily Users of Dapps like Binance or Metamask pay fees to utilize these protocols either for swapping tokens, buying or transfer of tokens. The proceeds from these fees are used to compensate liquidity providers for staking their own tokens in the pool according to the amount supplied by the user to that liquidity pool.

You Simply Provide Liquidity And Earn Returns At Huge Interest Rates

The interest in a yield farm investment is calculated in two ways: APY - Annual Percentage Yield (interesting rate including compound interest) and APR - Annual Percentage Rate (interest rate excluding compound interest). APY stands for Annual Percentage Yield and is the projected rate of annual return after taking compounding interest into account. The annual percentage rate (APR) is the cost of earning or borrowing money. Compounding is taken into account in APY, but not in APR. APR is exclusive of compounding interest.

A Preamble To Staking

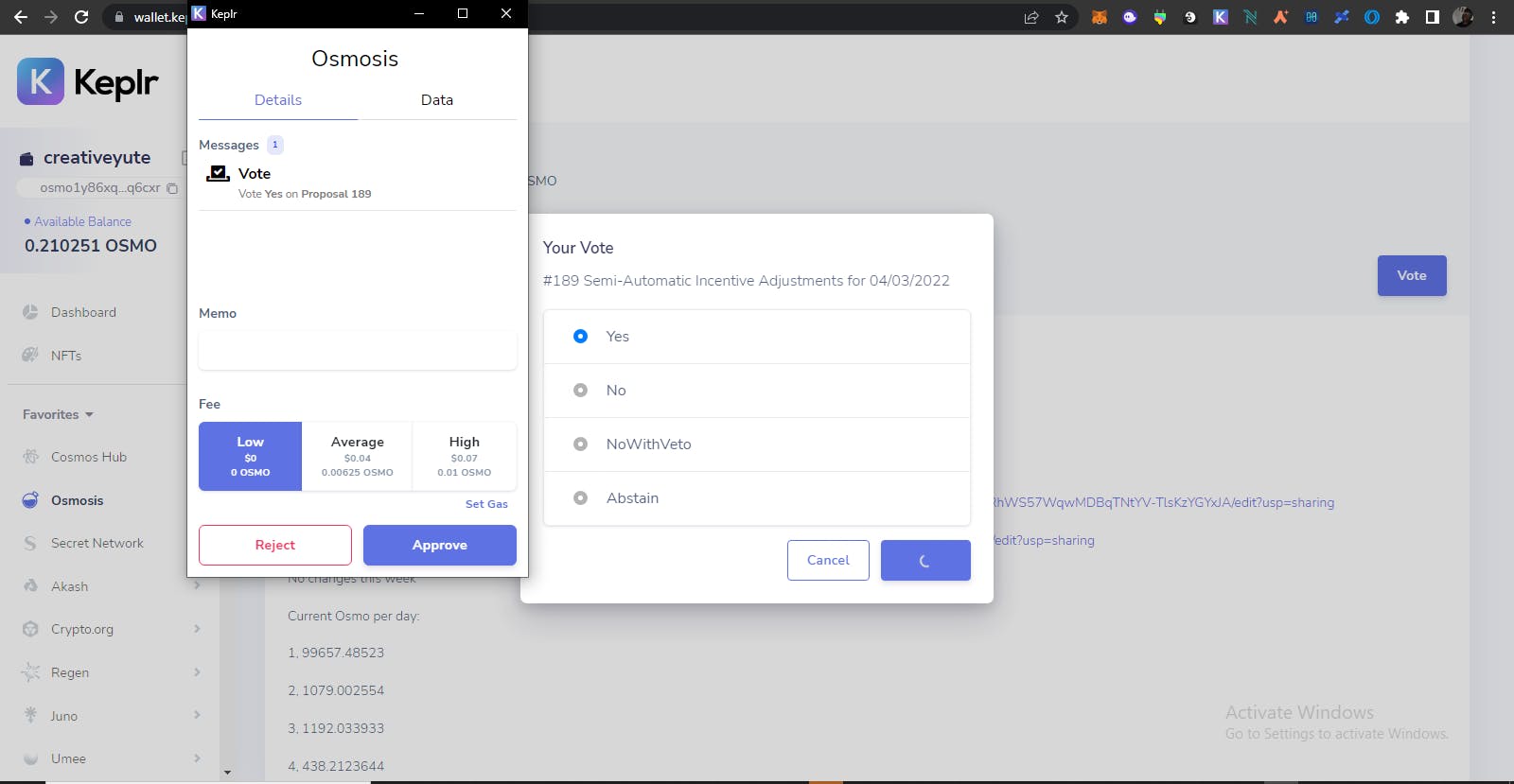

Staking is the process of locking up a digital asset (majorly tokens or cryptocurrencies) to provide economic security for a public blockchain and also improve the technology. Staking these tokens provides users the right to vote on proposals and make decisions on the future of the network. Earnings will begin to be generated soon as the staking transaction is completed. Stakeholders can use a wallet to submit a transaction at any time to claim their accrued incentives. This is usually seen as one of the easiest ways to build a blockchain network whilst giving users the opportunity to earn passive income for participation. It is largely a win-win scenario and offers lots of rewards to token holders.

In simple terms "Staking offers increased returns (or APR/APY) when investors choose to lock in their funds for prolonged periods. Yield farming, however, doesn't require investors to lock in their funds- (Liquidity providers)"

Let’s Take A Break Here

This might be overwhelming or a lot to take in at the same time. It’s only right that concepts like Staking, Validators and How to choose one, Wallets, and Practical Steps on How to stake and earn passive income from DEFI are discussed properly in another article. At the end of these series, you should be able to see blockchain and crypto differently.

So Keep Your Fingers Crossed and Be On The Look-Out.

Reach Out. Let’s Connect, Let’s Build!!!

If you’ve got any questions or feedback, I’d love to hear from you. I am also eager to hear your contributions on this topic or areas you might like me to write on such as; #tech #blockchain, #web3, #defi, #design, #leadership, #communities and #products. Drop me a line at creative.yute@gmail.com or reach out on my different social media accounts- LinkedIn, Twitter, Medium, Github, Mirror, Polygon.